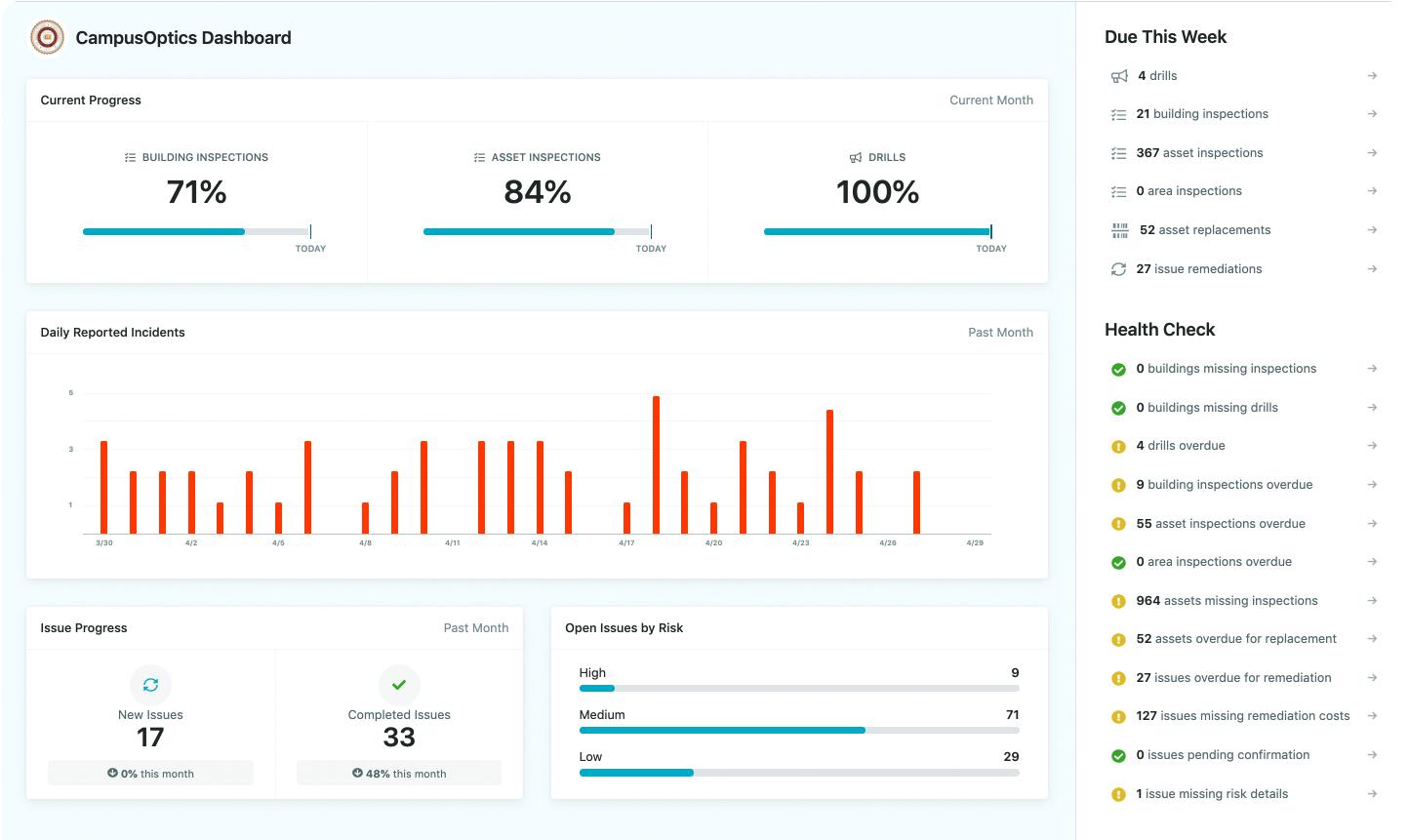

Get the Big Picture view of campus safety

CampusOptics is a cross-functional EH&S platform designed specifically for institutions of higher education. CampusOptics was created to help campus safety professionals improve collaboration, reduce institutional risk and enhance safety culture.

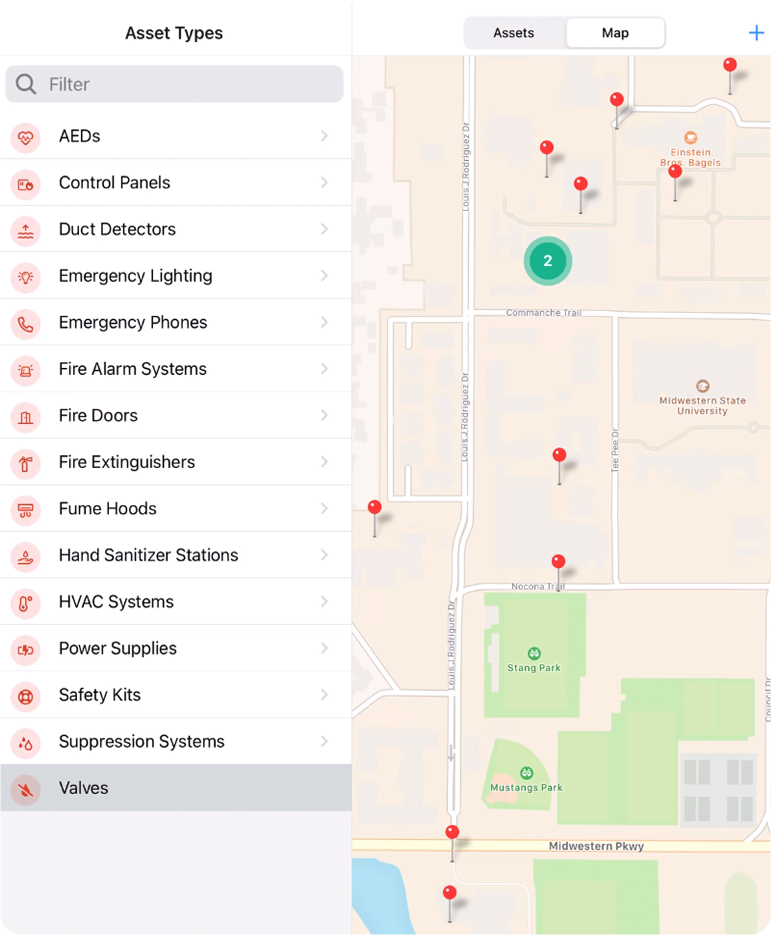

An EH&S solution that is as Mobile as you are

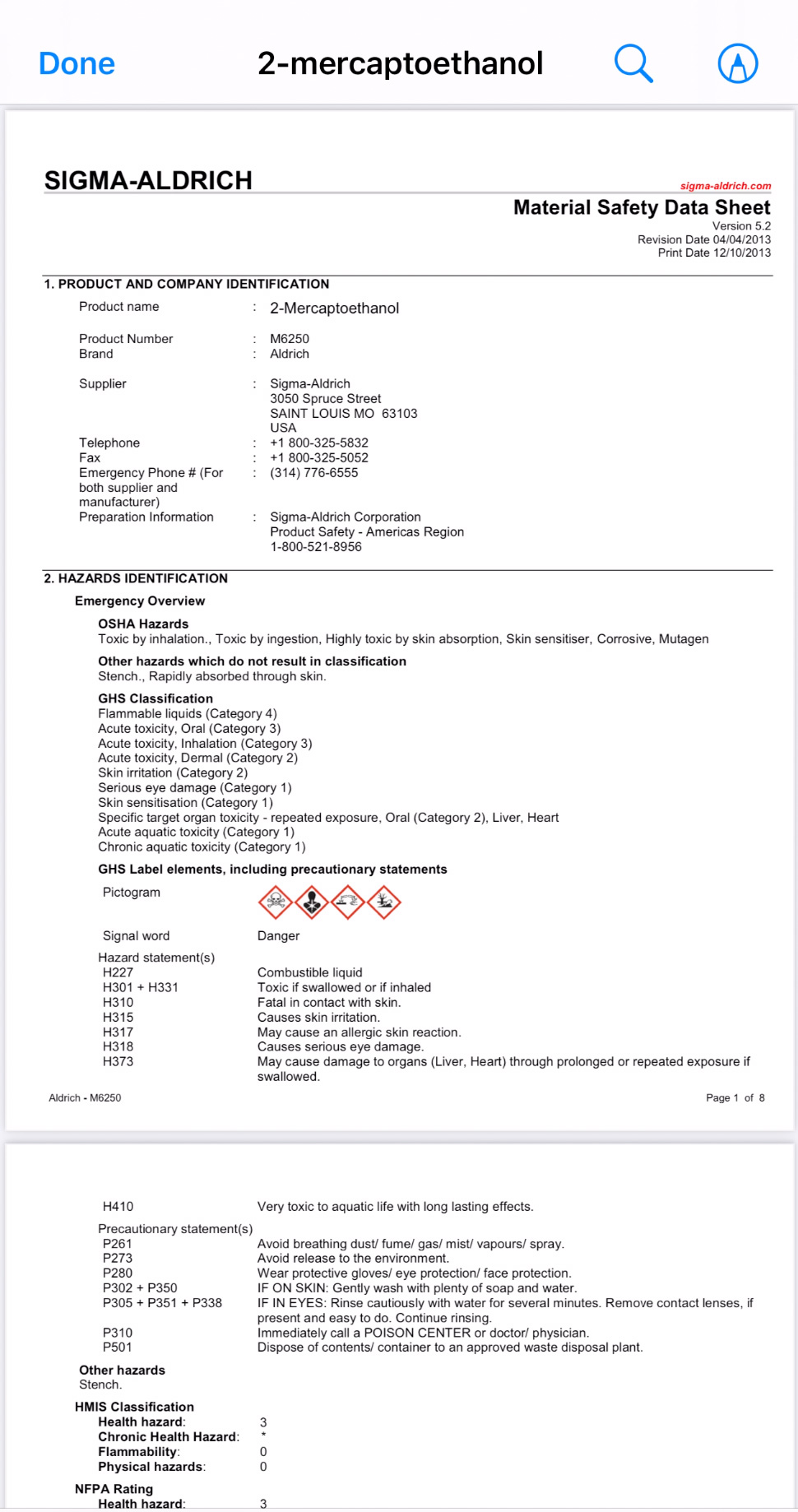

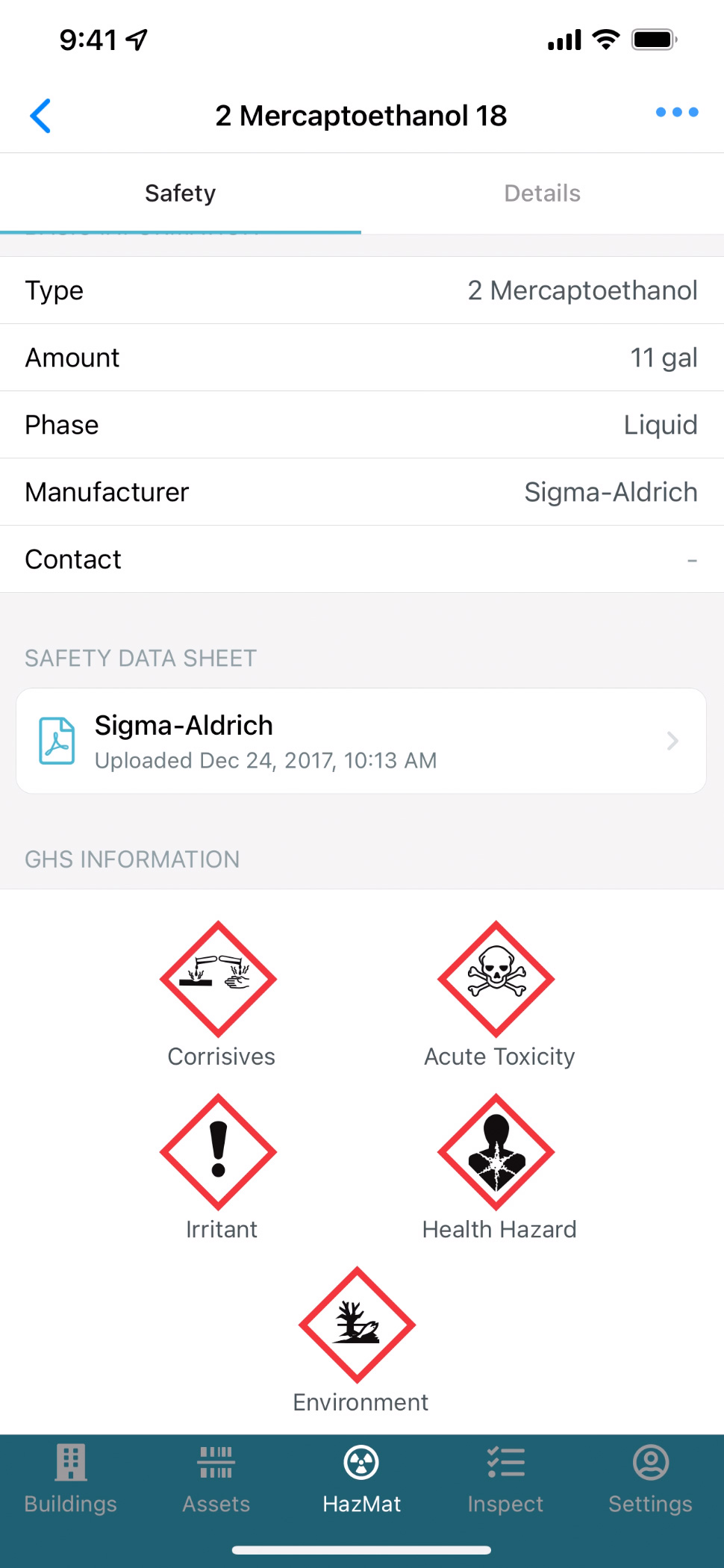

EH&S Professionals are almost never at their desks, which is why CampusOptics offers a mobile app for both IOS and Android devices to support on-the-go access to chemical inventory, hazardous waste containers, inspections, safety assets, incident records and emergency plans.

Barcode & QR code scanning

Use your device’s camera to scan bar/QR codes for key information on safety assets or chemical containers.

In-App Photos and Video

Quickly associate pictures and videos to assets, chemical containers, safety issues and inspection reports.

Talk-to-Text

Streamlin

Access Documents

Access key documents on your mobile device, including Safety Data Sheets, emergency plans, floor plans and product documentation.

Visualize your data

View the location of safety assets, chemical containers, incidents and safety related issues across campus. Generate public facing maps of key assets like AED’s and Blue Phones.

Locations can be mapped automatically via import or you can log coordinates using your mobile device.

Get the Big Picture view of campus safety

CampusOptics is a cross-functional EH&S platform designed specifically for institutions of higher education. CampusOptics was created to help campus safety professionals improve collaboration, reduce institutional risk and enhance safety culture.

You know how it goes in business these days – one wrong move with regulations, and you’re facing fines that could sink the ship. That’s where risk and compliance software steps in, like a trusty sidekick that helps spot potential pitfalls before they turn into disasters. I’ve seen companies scramble without it, and let me tell you, it’s not pretty. In this piece, we’ll chat about top 10 software platforms and what this software really does, why they’re a game-changer for everything from finance to healthcare, and some real-world tips on picking the right one for your setup.

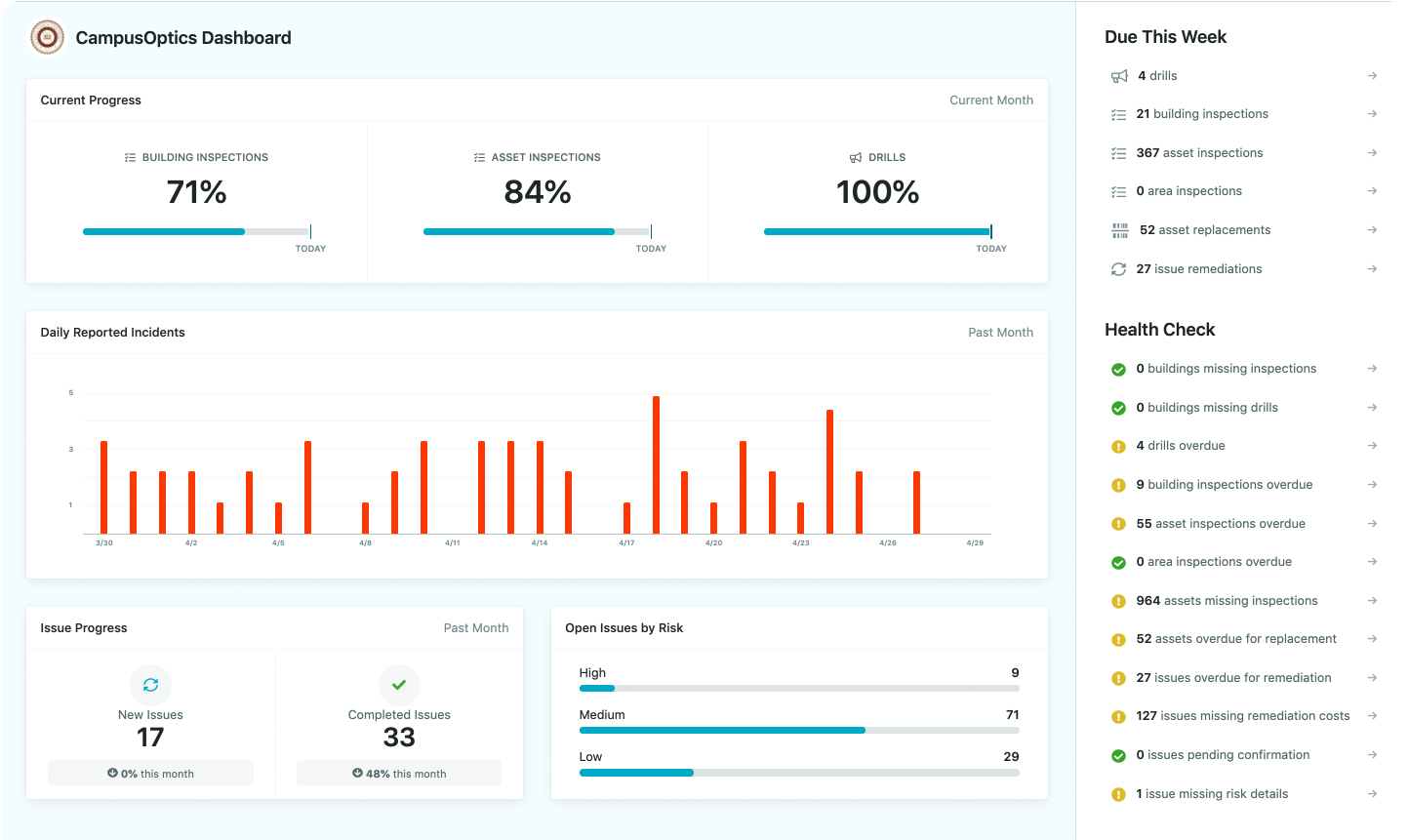

1. CampusOptics

We built CampusOptics as a platform geared toward environmental health and safety in colleges and universities, where managing risks means keeping tabs on everything from chemical inventories to emergency plans. It’s all about pulling together different teams so that safety pros can spot issues early and cut down on potential problems that could lead to bigger institutional headaches.

The platform includes tools like mapping out where safety gear is located or logging incidents on the fly, which helps in staying compliant with regulations without a ton of paperwork piling up. It’s interesting that it focuses on collaboration across functions, making sure everyone from risk managers to emergency planners can access what they need securely – that is why our risk and compliance software works. Overall, it seems like a straightforward way to handle the day-to-day risks that come with running a campus.

Key Highlights:

- Mobile app for iOS and Android to handle chemical inventory, inspections, and incident records while on the move.

- Barcode and QR code scanning for quick info on safety assets and containers.

- In-app photos, videos, and talk-to-text for easier reporting and note-taking.

- Data visualization for mapping safety assets, incidents, and issues across campus.

- Access to documents like safety data sheets and emergency plans directly from devices.

- Unlimited users with configurable permissions and SSO for secure data access.

Who it’s best for:

- Higher education institutions dealing with campus-wide safety and risk management.

- Environmental health and safety professionals who need mobile tools for fieldwork.

- Risk management teams focused on audits and insurance-related safety data.

- Fire and life safety experts tracking assets like AEDs and emergency phones.

- Emergency planning groups requiring quick access to plans and incident logs.

Contacts:

- Website: campusoptics.com

- App Store: apps.apple.com/us/app/campusoptics

- Google Play: play.google.com/store/apps/campusoptics.app&pcampaignid

- E-mail: contact@campusoptics.com

- Address: 7951 Shoal Creek Blvd., Suite 275 Austin, TX 78757

- Phone: (888)748-7652

2. Hyperproof

Hyperproof sets up a centralized spot for handling compliance and risks, where teams can automate a bunch of the grunt work involved in keeping things in check. They make it so you can pull together control data from various places, which helps in spotting risks without digging through endless files. It’s kind of practical how they tie in AI for things like answering security questions faster, avoiding the usual back-and-forth.

They also focus on building trust with outsiders by managing questionnaires and trust centers in one go, while integrating workflows to keep an eye on risks as they pop up. From what stands out, it’s about scaling up for bigger operations, with permissions that adapt to different teams or locations. This approach keeps compliance from becoming a bottleneck, letting folks concentrate on the business side.

Key Highlights:

- Automates controls and orchestrates tasks to cut down on manual efforts.

- Maps controls across multiple frameworks for handling various regulations.

- AI-driven responses for security questionnaires, with assignment and approval tracking.

- Centralizes evidence, policies, and certifications for consistent responses.

- Integrates risk monitoring for real-time views and issue resolution.

- Flexible permissions for teams across geographies and product lines.

Who it’s best for:

- Businesses scaling compliance across multiple entities or locations.

- Teams managing customer trust through questionnaires and trust centers.

- Organizations dealing with numerous regulatory frameworks.

- Risk workflows that need continuous monitoring and reporting.

- Companies looking to automate control management at an enterprise level.

Contacts:

- Website: hyperproof.io

- E-mail: info@hyperproof.io

- Facebook: www.facebook.com/hyperproof

- LinkedIn: www.linkedin.com/company/hyperproof

- Twitter: x.com/Hyperproof

- Address: 600 1st Ave Ste 330 PMB 78059, Seattle, WA, 98104-2246

- Phone: 833 497 7663

3. MetricStream

MetricStream puts together a connected platform for governance, risk, and compliance, using AI to handle everything from risk assessments to audit work. They aim to make decisions quicker by pulling in real-time insights on risks and compliance status. It’s notable how they automate things like ingesting regulatory changes or testing controls, which can prevent gaps that might otherwise slip through.

They cover areas like third-party risks and business resilience, with tools for simulations and response plans to stay ahead of disruptions. The setup encourages a proactive stance, where teams can focus on fixing issues rather than just documenting them. In a way, it ties the whole enterprise together, making risk management feel less isolated.

Key Highlights:

- AI-driven risk insights, assessments, and control effectiveness for operational efficiency.

- Automates compliance with regulatory updates, policy management, and incident handling.

- Continuous audits with AI for fieldwork, reporting, and highlighting control gaps.

- Real-time IT and cyber risk detection, with control validation and policy enforcement.

- Third-party onboarding, monitoring, and assessments for ecosystem resilience.

- Resilience assessments, simulations, and automated response plans for continuity.

Who it’s best for:

- Large enterprises needing interconnected risk and compliance across departments.

- Teams handling operational and enterprise risk with AI insights.

- Audit groups focused on internal audits and SOX compliance.

- Cyber GRC professionals dealing with IT risks and security frameworks.

- Organizations managing third-party and fourth-party risks.

- Businesses prioritizing resilience and proactive disruption planning.

Contacts:

- Website: www.metricstream.com

- App Store: apps.apple.com/ru/app/metricstream/id1436377546

- E-mail: info@metricstream.com

- LinkedIn: www.linkedin.com/company/metricstream

- Facebook: www.facebook.com/MetricStream

- Twitter: x.com/metricstream

- Address: 6201 America Center Drive, Suite 120, San Jose, CA 95002

- Phone: +1-650-620-2955

4. NAVEX

NAVEX connects data across people, processes, and tech to give a clearer picture of risks and compliance needs in organizations. They help in prioritizing what risks to tackle first, pulling everything into one platform for better oversight. It’s straightforward in how it links up intelligence to make decisions less guesswork-heavy, especially for ongoing compliance obligations.

They include solutions for whistleblowing, training, and policy management, all tied into the broader risk framework. What catches my eye is the emphasis on visibility and convenience, so teams aren’t juggling multiple tools. This makes managing compliance feel more integrated, with insights that help spot trends or issues early on.

Key Highlights:

- Connects data for full risk oversight and prioritization.

- Whistleblowing and incident management for transparency.

- Ethics and compliance training tailored to employee experiences.

- Policy and procedure tools for ongoing conversations.

- Risk and governance focus for regulations and insights.

- Services for consulting and support to maximize the platform.

Who it’s best for:

- Organizations seeking connected intelligence for global risk management.

- Teams handling compliance obligations across various business areas.

- Companies focused on whistleblowing and incident reporting.

- Groups needing training and policy tools for employee engagement.

- Businesses wanting unified data for better risk visibility.

Contacts:

- Website: www.navex.com

- LinkedIn: www.linkedin.com/company/navexinc

- Twitter: x.com/NAVEXInc

- Facebook: www.facebook.com/NAVEXInc

- Address: 5885 Meadows Road, Suite 500, Lake Oswego, OR, 97035, United States

- Phone: 1-866-297-0224

5. AuditBoard

AuditBoard offers a platform that links up audit, risk, and compliance teams, connecting risks, controls, and issues in one place. They use AI to handle repetitive tasks, letting folks zero in on bigger-picture choices. It’s practical for collaborating with frontline and executive levels, cutting out the mess of separate systems.

They include analytics tools that are easy to use without coding, for things like testing and identifying risks. The setup promotes a shift from reacting to issues to working together proactively. Interestingly, it scales with integrations across the compliance ecosystem, making it adaptable for enterprise needs.

Key Highlights:

- Unites teams by connecting risks, controls, frameworks, and issues.

- AI automates tasks like report creation and data connections.

- No-code analytics for testing, risk identification, and decisions.

- Unified data core for oversight and collaboration.

- Integrations spanning compliance and risk ecosystems.

Who it’s best for:

- Enterprise teams managing audit, risk, and compliance collaboratively.

- Organizations using AI for strategic focus over manual work.

- Groups needing analytics for data-driven risk management.

- Businesses seeking efficiency in stakeholder engagement.

- Companies aiming for deeper operational risk insights.

Contacts:

- Website: auditboard.com

- AppStore: apps.apple.com/us/developer/auditboard

- Facebook: www.facebook.com/auditboard

- LinkedIn: www.linkedin.com/company/auditboard

- Twitter: x.com/auditboard

- Address: 12900 Park Plaza Drive, Suite 200 Cerritos, CA 90703

6. RiskWatch

RiskWatch is designed to handle risk and compliance assessments across various industries, focusing on automating what used to be tedious manual tasks. It pulls together tools for tracking compliance with over 40 regulatory standards, from healthcare to finance, so teams can stay on top of audits without drowning in paperwork. The platform’s dashboard feels like a breath of fresh air for anyone juggling multiple assets, giving a clear view of risks and performance metrics in one spot.

What stands out is how RickWatch makes it adaptable, letting organizations tweak it to fit their specific needs, whether it’s physical security or cyber risks. The platform also includes policy management and vendor risk tools, which help keep everything from internal controls to third-party relationships in check. It’s a practical setup for those who need to keep a tight grip on compliance while moving fast.

Key Highlights:

- Supports over 40 compliance frameworks for risk and security assessments.

- Real-time dashboard for tracking assessment status and results.

- Automates reminders for assessments and tasks to streamline workflows.

- Handles physical security, cyber risks, and third-party vendor assessments.

- Policy management tools for creating and distributing procedures.

- Scalable and cloud-based for use across devices and enterprise assets.

Who it’s best for:

- Organizations managing multiple regulatory compliance requirements.

- Teams in healthcare, finance, or manufacturing needing tailored risk tools.

- Companies focused on physical security and cyber risk assessments.

- Businesses seeking automated reporting and real-time risk insights.

- Groups managing vendor risks alongside internal compliance.

Contacts:

- Website: www.riskwatch.com

- E-mail: sales@riskwatch.com

- Address: U. S. Headquarters RiskWatch International 1680 Fruitville Rd, # 535 Sarasota, FL 34236

- Phone: 941-500-4525

7. ServiceNow

ServiceNow brings a unified platform to the table, tying together risk, compliance, and business continuity with a heavy lean on AI and automation. It connects data across IT, security, and business functions, making it easier to spot risks and keep compliance on track without siloed processes. It’s the kind of system that feels built for big organizations where coordination across teams is a constant challenge.

The platform includes features like continuous monitoring and predictive analytics, which help teams stay proactive about risks rather than just reacting to them. From vendor risk management to policy automation, it’s all about centralizing data to make decisions faster. The platform’s flexibility across industries like banking or healthcare makes it a solid pick for complex setups.

Key Highlights:

- Unifies risk, compliance, and IT functions on a single platform.

- Automates policy lifecycle and control monitoring for compliance.

- Vendor risk management for third-party oversight.

- Predictive analytics for proactive risk identification.

- Business continuity tools for planning and recovery.

- Performance analytics for real-time risk and compliance insights.

Who it’s best for:

- Large enterprises needing integrated risk and compliance across functions.

- Teams in regulated industries like banking, healthcare, or government.

- Organizations focused on automating compliance and policy management.

- Businesses requiring robust vendor risk and business continuity tools.

- Groups looking for data-driven insights to improve decision-making.

Contacts:

- Website: www.servicenow.com

- Google Play: play.google.com/store/apps/servicenow.fulfiller&pcampaignid=web_share

- Instagram: www.instagram.com/servicenow

- LinkedIn: www.linkedin.com/company/servicenow

- Twitter: x.com/servicenow

- Facebook: www.facebook.com/servicenow

- Address: 2225 Lawson Lane Santa Clara, CA 95054

8. ZenGRC

ZenGRC takes a straightforward approach to governance, risk, and compliance, aiming to cut through the complexity of managing regulatory requirements. They offer a single platform where teams can store and access all their compliance data, from evidence collection to risk scoring. It’s refreshing how they prioritize ease of use, so even those new to GRC don’t feel overwhelmed.

It leans on AI to automate tasks like evaluating controls and integrate with frameworks like ISO or HIPAA, which helps teams stay compliant without constant manual updates. The trust center feature is a nice touch, letting organizations share their security posture with stakeholders securely. It’s built for those who want a no-fuss way to handle compliance while keeping risks in check.

Key Highlights:

- Centralized system for storing risk and compliance data.

- AI-driven automation for control evaluation and task management.

- Supports frameworks like ISO, PCI, SOC, and HIPAA.

- Trust center for sharing compliance documentation with stakeholders.

- Streamlined evidence collection with reusable controls.

- Customizable to fit specific organizational risk needs.

Who it’s best for:

- Organizations seeking a simple, unified GRC platform.

- Teams needing flexible framework integration for compliance.

- Companies focused on sharing security posture with customers.

- Businesses automating evidence collection and control tasks.

- Groups requiring scalable solutions for growing risk needs.

Contacts:

- Website: www.zengrc.com

- E-mail: engage@zengrc.com

- LinkedIn: www.linkedin.com/company/zengrc

- Twitter: x.com/ZenGRC

- Address: 548 Market St PMB 73905 San Francisco, CA 94104-5401

9. Drata

Drata focuses on turning compliance and risk management into a business advantage by automating much of the heavy lifting. They use AI to streamline tasks like control monitoring and evidence collection, making it easier for teams to stay audit-ready across frameworks like SOC 2 or ISO 27001. It feels like a platform built for speed, especially for companies aiming to scale fast.

They also emphasize building trust with customers through features like a trust center and AI-powered questionnaire responses, which cut down on repetitive work. The ability to integrate with cloud providers and customize workflows makes it adaptable for varied environments, from startups to larger enterprises. It’s a solid choice for those who see compliance as a growth driver.

Key Highlights:

- AI-powered automation for control monitoring and evidence collection.

- Trust center for sharing security and compliance details.

- Supports certifications like SOC 2, ISO 27001, and FedRAMP.

- Integrates with cloud and identity platforms for seamless workflows.

- Customizable controls and tests for enterprise flexibility.

- Accelerates security reviews with AI-driven questionnaire responses.

Who it’s best for:

- Fast-growing startups and enterprises needing scalable compliance.

- Teams pursuing certifications like SOC 2 or ISO 27001.

- Companies focused on building customer trust through transparency.

- Organizations automating compliance to speed up sales cycles.

- Groups needing flexible integrations for cloud-based operations.

Contacts:

- Website: drata.com

- E-mail: getstarted@drata.com

- LinkedIn: www.linkedin.com/company/drata

- Twitter: x.com/dratahq

10. Resolver

Resolver aims to transform risk management into a strategic tool, connecting incident reporting, compliance, and risk assessments into one platform. It focuses on giving teams a clear view of risks across digital and physical spaces, with analytics to prioritize what needs attention first. It’s the sort of setup that feels useful for organizations dealing with constant change.

It also includes tools for everything from enterprise security to brand protection, with a strong emphasis on post-incident analysis to prevent repeat issues. The platform’s ability to streamline compliance testing and automate reporting makes it easier to stay aligned with regulations. It’s practical for those who want to tie risk management directly to business outcomes.

Key Highlights:

- Connects risk, compliance, and incident management in one platform.

- Real-time analytics for prioritizing and mitigating risks.

- Automates compliance testing and executive reporting.

- Enterprise security tools for incident and threat resolution.

- Business continuity planning to minimize operational disruptions.

- Post-incident analytics for root-cause analysis and control refinement.

Who it’s best for:

- Organizations needing integrated risk and compliance management.

- Teams in industries with complex regulatory requirements.

- Companies focused on enterprise security and incident response.

- Businesses prioritizing brand protection and reputation management.

- Groups seeking analytics-driven insights for risk and compliance.

Contacts:

- Website: www.resolver.com

- Instagram: www.instagram.com/resolverinc

- LinkedIn: www.linkedin.com/company/resolver-inc

- Twitter: x.com/resolver

- Facebook: www.facebook.com/resolverinc

Conclusion

Risk and compliance software has become a lifeline for organizations navigating today’s tangle of regulations and risks. Whether it’s keeping up with ever-changing compliance rules or spotting potential issues before they spiral, these tools pull a lot of weight. They’re not just about checking boxes – they help teams work smarter, automate the boring stuff, and make decisions with a clearer picture of what’s at stake. From campus safety to global enterprises, there’s a platform for every need, each with its own way of tackling the mess of risk management.

What strikes me is how these solutions reflect the real-world grind of staying compliant while trying to grow a business. They’re not perfect, and picking the right one depends on your specific setup – whether you’re a small team needing simplicity or a sprawling organization juggling multiple frameworks. The key is finding a tool that fits your workflow without adding more headaches. With risks popping up faster than ever, these platforms are less a luxury and more a necessity to keep things running smoothly.